Mike | The Lab

Published on

Nov 25, 2025

Trading without a journal routine is like navigating without instruments. You might hit a few wins, but you’re relying on luck instead of data.

Most traders start a journal then abandon it after a few weeks. The professionals who succeed? They build journaling habits that transform raw trade into actions.

Here’s how to establish a trading journal routine backed by the strategies professional traders use to maintain discipline.

What Makes a Trading Journal Routine

A journal captures what happened, it determines when, how and why you document your trades. It's the system that ensures your journal stays current, comprehensive, and useful.

Think it like your journal is the tool and the routine is the technique that makes the tool effective.

The difference between traders who benefit from journaling and those who don't comes down to consistency. One week of detailed entries followed by three weeks of nothing provides zero statistical value. Consistent documentation over months reveals patterns that predict future performance.

Why consistency matters more than perfection

Discipline separates profitable traders from breakeven ones. A consistent journal routine builds that discipline. When you commit to documenting every trade regardless of outcome, you're training yourself to follow process over emotion.

The real test isn't journaling after winners when motivation is high. It's logging the details after a brutal losing streak when you want to close your platform and walk away. That's when routine carries you through. That's when the habit proves its value.

Consistency also enables pattern recognition. Twenty trades documented this month and fifteen next month creates data gaps. One hundred consecutive trades with complete documentation reveals statistical truths about your edge, your mistakes, and your psychology.

Setting Up Your Trading Journal System

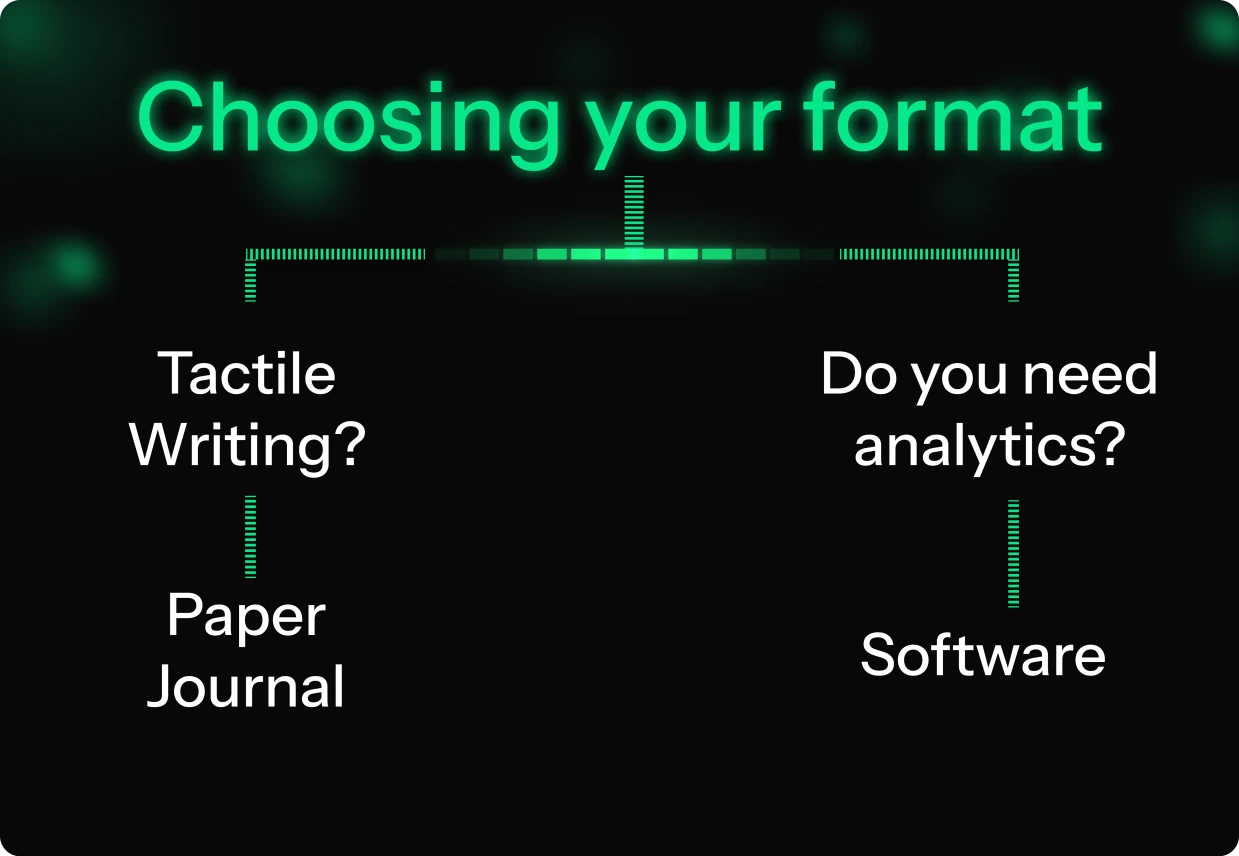

Choose your format: Physical journals are great because of the tactile feedback, but they lack analytical capabilities, you can’t easily calculate win rates, performance curves or filter data. On the other hand, Excel, Google Sheets or specialized sofware can all automatically calculate, generate reports and visualize patterns, reducing the friction between trading and journaling.

Define Data Points: Your journal should capture informations to be useful without becoming overwhelming. Every entry needs:

Trade Specifics: Date and time, instrument traded, direction (long or short), entry price, exit price, position size, profit or loss

Strategy Context: Setup type used, market conditions, timeframe, pre-trade checklist completion

Execution Quality: Did you follow your plan, mistakes made, what worked well, what needs improvement

Psychological State: Emotional state before entry, feelings during the trade, mental clarity at exit

Building Your Daily Routine

Do a market briefing pre-market, it will help you setting up the expectations and you can use them to later journal, did you follow the plan you had in mind?

Journal as soon as you close the trade, the details are fresh, emotions are still strong and you can remember everything.

Take a few hours to rest and then review with a clear mind, this way you can be more objective.

Implementing Weekly Analysis Sessions

Daily documentation captures data. Weekly analysis extracts insights. Schedule 60 to 90 minutes every weekend dedicated to deep review.

Review Your Week's Performance

Pull up every trade from the week and look for:

Plan Adherence: How often did you follow your complete setup criteria? Which rules did you break most frequently? Were deviations profitable or costly?

Strategy Performance: Which setups delivered the best results? Which consistently underperformed? Are win rates and risk-reward ratios meeting expectations?

Risk Management: Did position sizing stay consistent? Were stop losses honored? Did risk per trade align with your rules?

Psychological Patterns: Which emotions drove mistakes? What mental states correlated with best performance? Are there specific triggers causing impulsive decisions?

Document these observations in a weekly summary section. Over time, these summaries reveal macro trends that daily entries miss.

Calculate Key Metrics

Numbers don't lie. Every week, calculate:

Win rate, average win size, average loss size, risk-reward ratio, largest winner, largest loser, profit factor, expectancy per trade

Track these metrics week over week. Are they improving, declining, or stagnant? Which numbers matter most for your strategy?

Identify Actionable Improvements

Monday leads to bad trading results? Cut Monday Sizing over 500$ makes your trading performances worse? Cut size

The first 30 minutes after market open is the worst trading window for your model? Wait until 10:00 to trade

Find patterns and implement them.

Optimize Your Strategy Playbook

Which strategies in your arsenal are pulling their weight? Your nalysis should reveal:

Strategies to increase frequency because they consistently deliver, setups to refine because they show promise but need adjustment, approaches to eliminate because they drain more than they produce

Be ruthless. Cutting strategies with negative expectancy is as important as scaling strategies with positive expectancy. Your journal provides the evidence to make these decisions objectively.

Don’t just take trades because “It’s the model”.

Common excuses that ruin your journal

I dont’ have time.

This is the most common excuse but also the easiest to solve. Journaling doesn’t require hours. On a weekly basis you will only invest 2/3 hours worth of journaling. Dedicate some time to it, if you want to trade seriously.

I’m too emotional after losses.

Emotion makes you want to skip documentation. That's precisely when documentation matters most. Your worst trading days provide your most valuable data.

Biggest losers require immediate journaling before you can leave your desk. The pain is highest then, which means your memory is sharpest and your motivation to prevent repeats is strongest.

My journaling isn’t improving my performances.

Documenting alone doesn't create improvement. Analyze and implement to create space for improvement.