Mike | The Lab

Published on

Jan 4, 2026

What Is Crypto Trading?

Cryptocurrency trading offers access to a 24/7 global market with volatility that creates opportunities stocks can't match. With the right framework, crypto provides diversification, leverage options, and profit potential in both directions. Without understanding the fundamentals, it becomes expensive speculation.

Most traders jump into crypto chasing quick gains without grasping how blockchain works, how to secure assets, or which strategies match their risk tolerance. The successful ones? They master the mechanics before risking capital. They understand that crypto is a market, not a lottery.

What Is Crypto Trading?

Crypto trading means buying and selling digital currencies to profit from price movements. Unlike traditional currencies controlled by central banks, cryptocurrencies operate on decentralized networks secured by blockchain technology.

Each cryptocurrency represents a digital record of ownership stored across a distributed network. When you trade crypto, you're exchanging these digital assets at current market prices, speculating that future prices will move in your favor.

The crypto market operates continuously, 24 hours per day, 7 days per week. There are no market close times like traditional stock exchanges. This constant availability creates both opportunity and risk as price movements happen around the clock.

How Cryptocurrency Markets Function

Cryptocurrency markets are decentralized, running on a global network of computers rather than a centralized exchange. Prices are determined purely by supply and demand dynamics across multiple trading platforms simultaneously.

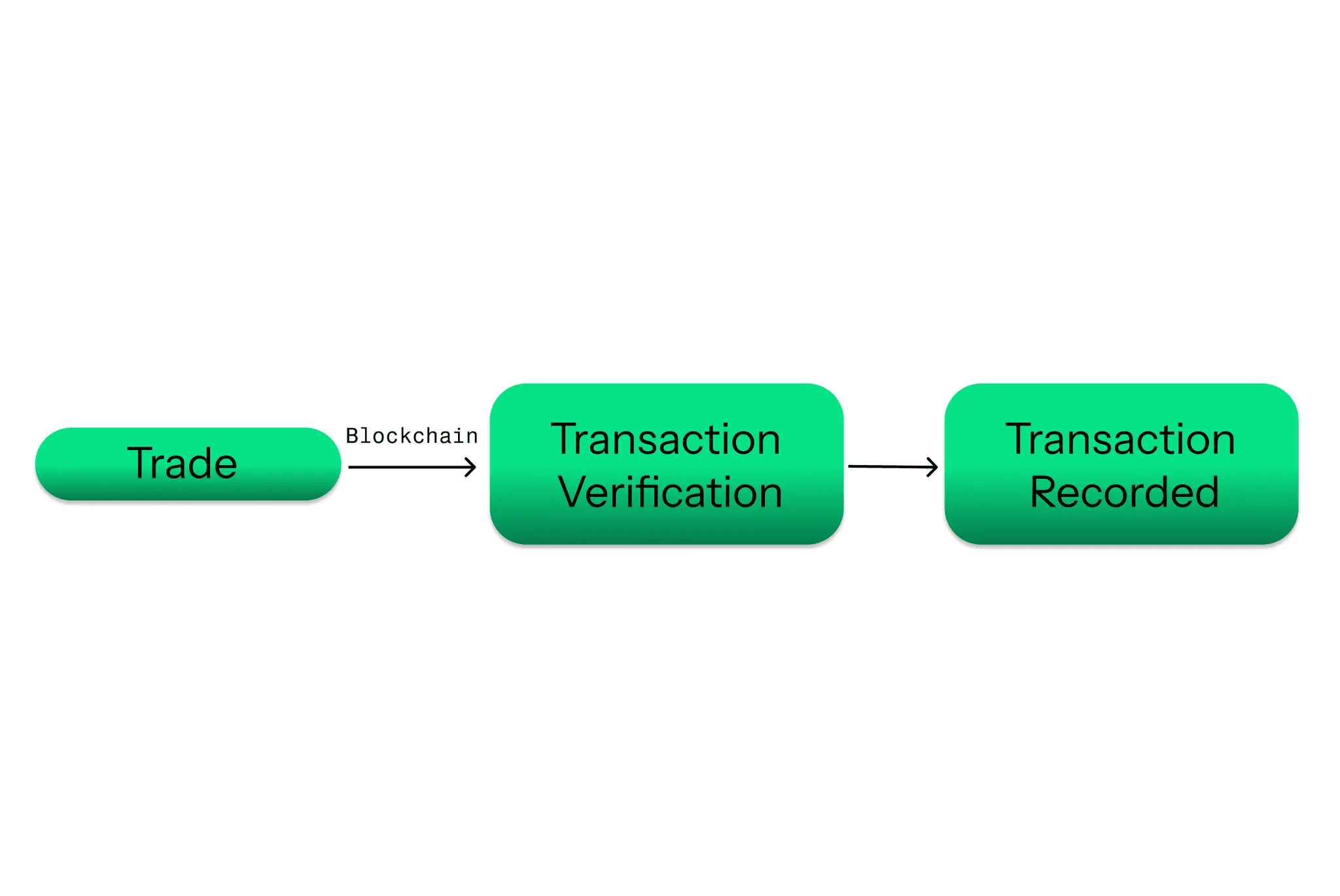

When you execute a trade, the transaction gets verified through the blockchain network and recorded permanently in the distributed ledger. This verification process ensures the transaction is legitimate, the buyer has sufficient funds, and the seller authorized the transfer.

The decentralized nature means no single entity controls prices or trading hours. Market manipulation is harder, but regulatory protection is also limited. You're responsible for your own security and decision making.

What Is a Blockchain?

A blockchain is a distributed digital ledger that records transactions across multiple computers simultaneously. Each transaction is a "block" that gets added to the "chain" of previous transactions in chronological order.

This structure creates an immutable record. Once a transaction is verified and added to the blockchain, it cannot be altered or deleted. Every participant in the network has access to the complete transaction history, providing transparency and security.

The decentralized storage across thousands of computers means there's no single point of failure. To alter blockchain data, you'd need to simultaneously compromise the majority of computers in the network, a practically impossible task.

How Blockchain Secures Cryptocurrency

When you initiate a crypto transaction, it broadcasts to the network for verification. Miners or validators check that you own the cryptocurrency you're sending and that you haven't already spent it elsewhere.

Valid transactions get bundled into blocks and added to the chain through a consensus mechanism. For Bitcoin, this is proof-of-work mining. For Ethereum post-merge, it's proof-of-stake validation. Different cryptocurrencies use different consensus methods.

This verification process happens automatically in the background. As a trader, you simply see transaction confirmation times ranging from seconds to minutes depending on the blockchain and network congestion.

Private Keys

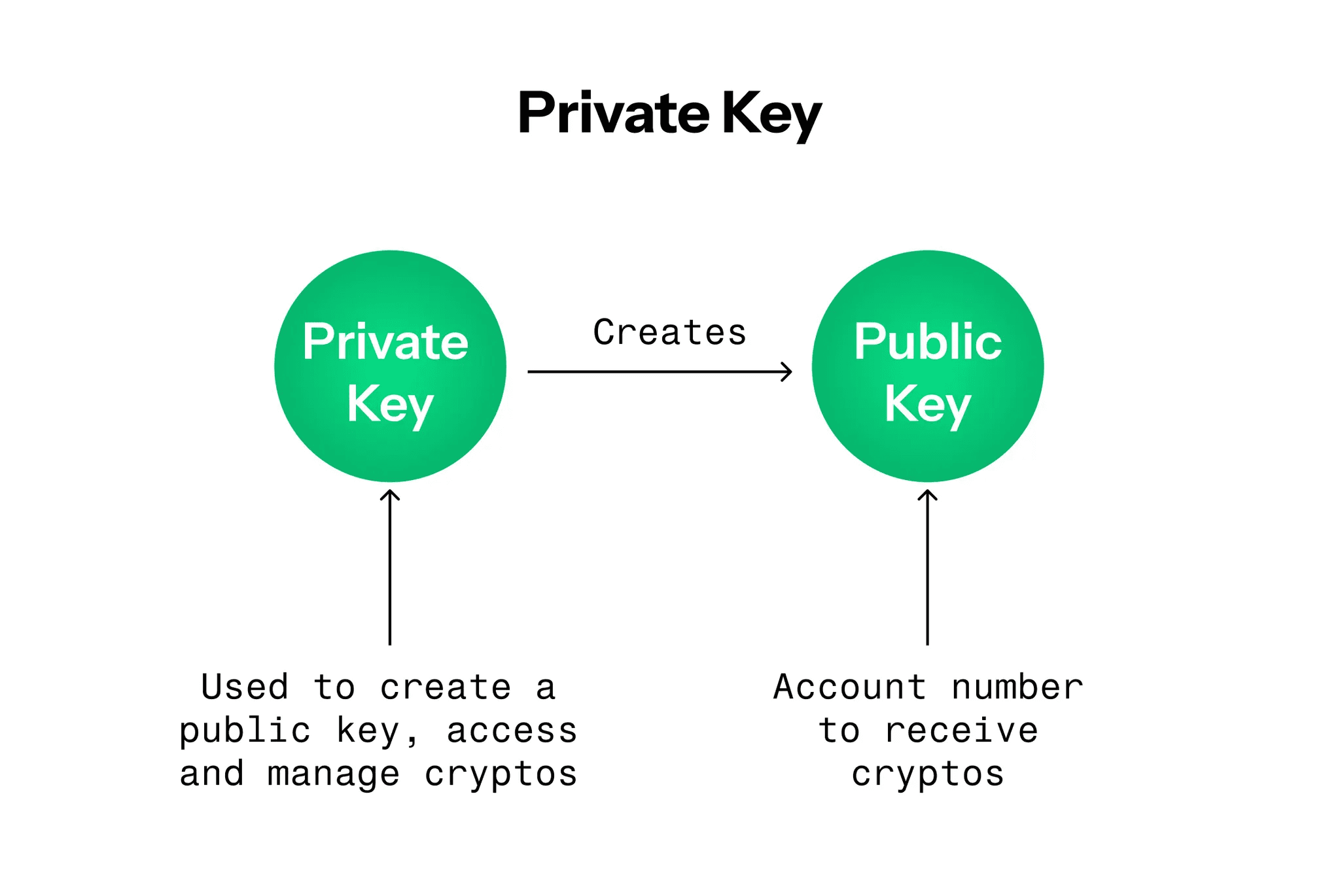

Private keys are the most critical security element in cryptocurrency trading. Understanding how they work prevents the permanent loss of your assets.

What Is a Private Key?

A private key is an alphanumeric code, typically hundreds of digits long, that proves ownership of your cryptocurrency. Think of it as the password to your digital wallet, but one that's cryptographically linked to your specific assets.

When you execute a transaction, your private key creates a digital signature that authorizes the transfer. Without this key, no one can access or move your cryptocurrency, not even the blockchain network itself.

This provides powerful security against theft, assuming you protect your key properly. However, if you lose your private key or it gets stolen, there's no recovery process. Your cryptocurrency becomes permanently inaccessible. No customer service can help you recover lost keys.

How to Secure Your Private Keys

Your digital wallet automatically generates and stores your private key. You don't need to memorize these complex codes, but you must secure them properly.

Hot Wallets: Wallets connected to the internet for convenience. Exchange accounts like Coinbase or Binance store your keys on their servers. Quick access for trading but vulnerable to hacks. Use hot wallets only for amounts you're actively trading.

Cold Wallets: Offline storage methods providing maximum security. Options include hardware wallets (USB devices like Ledger or Trezor), paper wallets (printed QR codes), or air-gapped computers never connected to the internet.

Best Practice: Keep the majority of your holdings in cold storage. Transfer only what you need to hot wallets when you're ready to trade. This limits your exposure if an exchange gets hacked or your hot wallet is compromised.

Never share your private key with anyone. Legitimate services never ask for your private key. If someone requests it, assume it's a scam.

Where to Trade Cryptocurrency

Two primary venues exist for crypto trading: centralized exchanges and over-the-counter markets.

Centralized Exchanges

Exchanges like Binance, Coinbase, Kraken, and Gemini act as intermediaries between buyers and sellers. They provide liquidity, order matching, and user-friendly interfaces for executing trades quickly.

Advantages: Quick execution at market prices, high liquidity for major cryptocurrencies, user-friendly platforms, wide selection of trading pairs

Disadvantages: Security risk from hacks, "not your keys, not your crypto" custody model, potential regulatory shutdowns, withdrawal limits and fees

Over-the-Counter (OTC) Trading

OTC trading removes the exchange middleman, allowing direct negotiation between parties. This method works best for large transactions where exchange liquidity might cause slippage.

Advantages: Price negotiation potential, better rates for large volumes, no exchange fees, privacy for large transactions

Disadvantages: Counterparty risk without exchange protection, requires finding trustworthy parties, less convenient for small trades, more complex execution process

Getting Started with Crypto Trading

Educational Foundation

Before trading real capital, invest time in education. Understand blockchain basics, how different cryptocurrencies function, technical analysis fundamentals, and risk management principles.

Paper trade strategies to see how they perform without risking capital. Track theoretical positions in your trading journal to understand P&L dynamics before committing real money.

Many successful crypto traders spent months learning before placing their first trade. The complexity and risk reward preparation.

Start Small

Begin with small position sizes you're comfortable losing completely. Crypto's volatility means you'll experience losses. Starting small allows you to learn from mistakes without catastrophic consequences.

Use major cryptocurrencies like Bitcoin or Ethereum initially. These have the most liquidity and slightly less volatility than smaller altcoins. Build experience before trading exotic tokens.

Choose the Right Exchange

Research exchanges thoroughly before depositing funds.

Track Everything

Maintain a detailed trading journal documenting every trade. Record entry and exit prices, position sizes, reasons for the trade, emotional state, and lessons learned.

Crypto trading generates complex tax implications. Detailed records help with tax reporting and performance analysis. Track which strategies work, which market conditions favor your approach, and where mistakes consistently occur.

Generic stock journals often miss crypto-specific data points like funding rates, gas fees, and blockchain confirmations. Use a journal designed for cryptocurrency trading or customize templates to capture relevant metrics.