Mike | The Lab

Published on

Dec 31, 2025

How to backtest trading strategies

Backtesting transforms speculation into evidence-based trading. With proper historical testing, you identify which strategies have statistical edge before risking real capital. Without backtesting, you're trading blind, relying on hope instead of data.

Most traders skip backtesting entirely or do it incorrectly, leading to false confidence in strategies that fail live. The successful ones? They test consistently, avoid common pitfalls, and only trade strategies proven through hundreds of historical simulations.

Here's everything you need to know about backtesting trading strategies, from data preparation to result analysis, backed by the frameworks professional traders use to validate edge before deployment.

What is backtesting and why it matters

Backtesting is the process of testing a trading strategy against historical market data to evaluate its potential performance. You apply your strategy's entry and exit rules to past price data, simulating trades as if you had executed them in real-time.

The goal is to answer one critical question: Would this strategy have made money in the past? If a strategy can't perform well on historical data, it's unlikely to succeed going forward.

Backtesting provides objective metrics about strategy performance, win rate, average gain versus average loss, maximum drawdown, profit factor, and other statistics that reveal whether your approach has genuine edge or is simply random guessing.

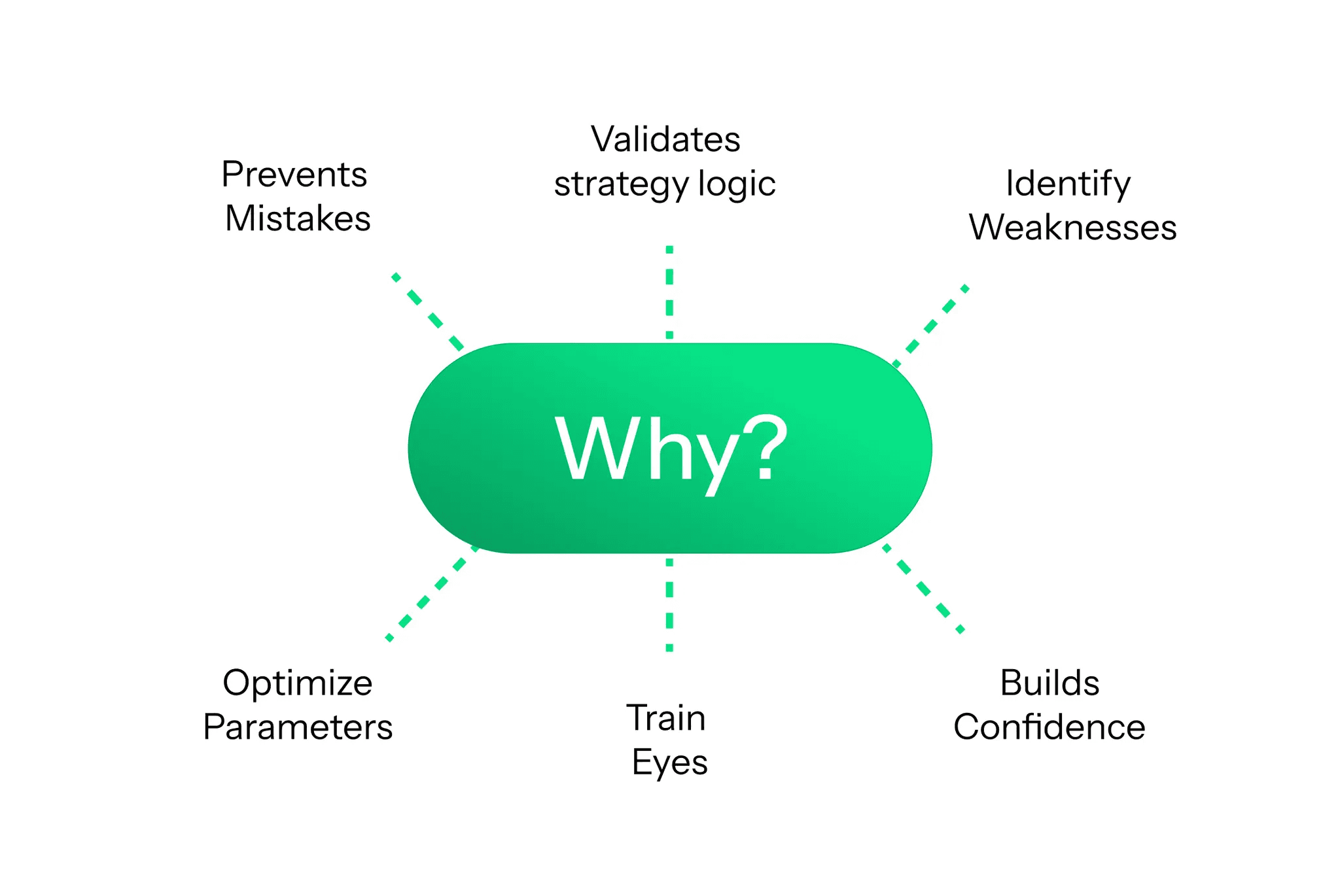

But why it matters?

Validates Strategy Logic: Tests whether your trading thesis holds up under real market conditions across extended periods

Identifies Weaknesses: Reveals flaws in strategy design, parameter choices, or market assumptions before live trading exposes them

Builds Confidence: Seeing positive results across hundreds of historical trades creates psychological foundation to execute the strategy during inevitable losing streaks

Optimizes Parameters: Allows systematic testing of different settings to find optimal balance between performance and robustness

Prevents Costly Mistakes: Catches strategy flaws in simulation rather than discovering them with real capital at risk

Without backtesting, you're essentially guessing. With thorough backtesting, you're operating from evidence.

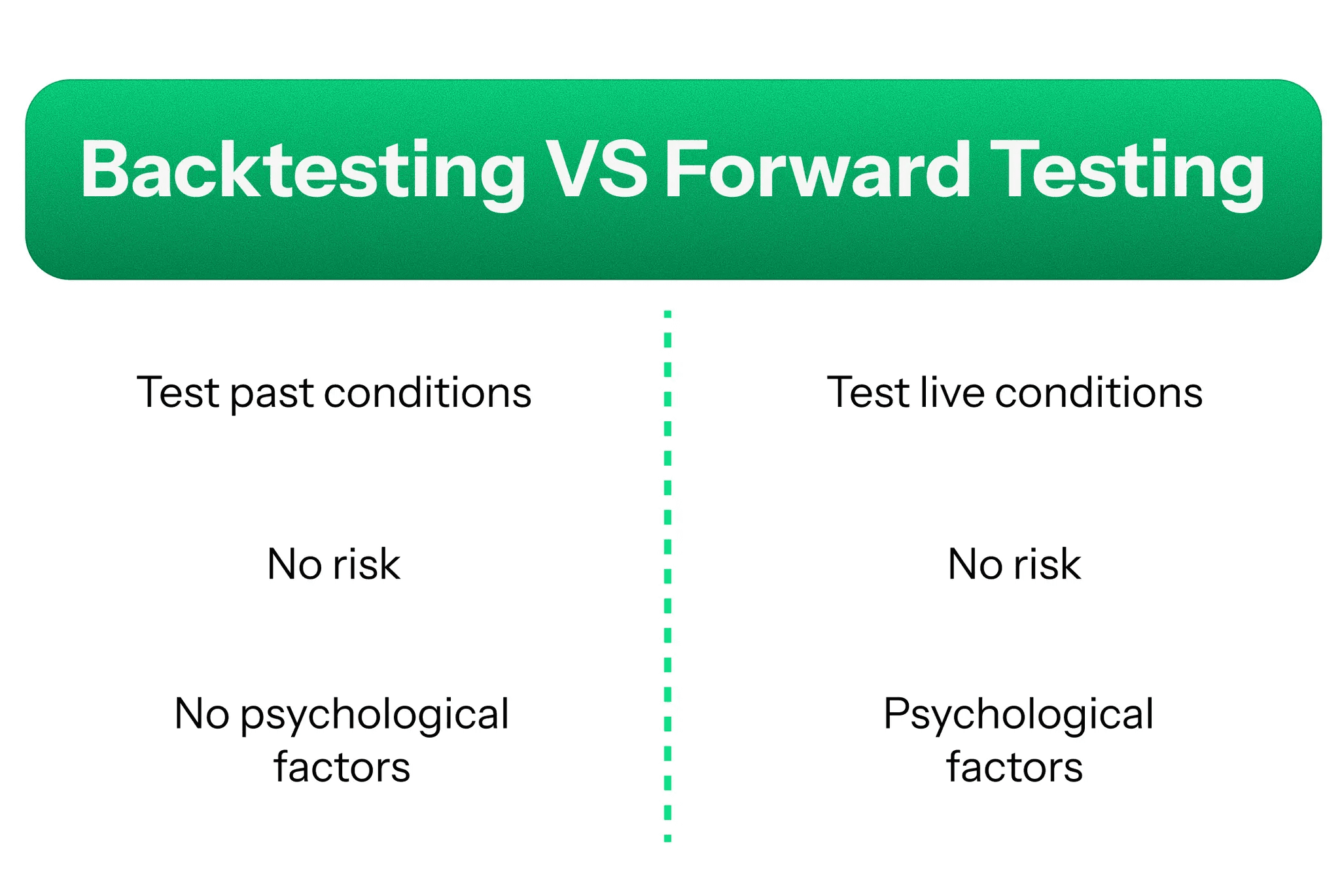

Backtesting vs Forward Testing

Both backtesting and forward testing validate strategies, but they serve different purposes and occur at different stages.

Backtesting (Historical Testing)

What It Is: Testing strategy against past data to see how it would have performed

When To Use: Initial strategy validation before risking any capital, even paper trading capital

Advantages: Fast results (test years of data in hours), complete control over conditions, ability to iterate quickly

Limitations: Historical performance doesn't guarantee future results, can't capture execution challenges, easier to introduce bias

Forward Testing (Paper Trading)

What It Is: Testing strategy in real-time market conditions with simulated capital

When To Use: After successful backtesting, before live trading with real money

Advantages: Tests strategy in current market conditions, captures execution challenges, includes psychological factors

Limitations: Time-consuming (must wait for real-time price action), doesn't test strategy across different market environments

Optimal Workflow: Backtest → Forward test → Live trading with small size → Scale up

Skipping either step increases failure probability. Backtesting without forward testing misses real-time execution issues. Forward testing without backtesting wastes time on strategies with no historical edge.

Preparing Your Backtesting Session

Before testing strategies, establish the framework for your analysis.

Select Your Symbols

Identify specific assets for testing. Don't just test "stocks" generically. Test specific symbols with historical data available.

Futures Examples: ES (S&P 500 E-mini), NQ (Nasdaq E-mini), CL (Crude Oil), GC (Gold)

Forex Examples: EURUSD, GBPUSD, USDJPY, AUDUSD

Stock Examples: SPY (S&P 500 ETF), AAPL, TSLA, or stocks meeting specific criteria (market cap, sector, liquidity)

Choose symbols that match your intended trading universe. Testing a strategy on highly liquid futures that you plan to trade on illiquid small-cap stocks produces irrelevant results.

Acquire Quality Historical Data

Data quality determines result validity. Garbage data produces garbage insights.

More data provides better statistical significance but ensure market conditions within the data range remain relevant. Testing a strategy on 1980s stock data may not reflect current market microstructure.

Choose Your Timeframe

Timeframe selection depends on your trading style and strategy type.

Intraday Timeframes: 1 minute, 5 minute, 15 minute charts for day trading and scalping strategies

Swing Trading Timeframes: 1 hour, 4 hour, daily charts for positions held multiple days

Position Trading Timeframes: Daily, weekly charts for longer-term trend following

Multiple Timeframe Analysis: Use higher timeframe for trend direction, lower timeframe for entry refinement. Test on the timeframe you'll actually use for execution.

Define Trading Hours

Different sessions exhibit different characteristics. Your backtest must match your intended trading hours.

Testing a strategy across 24 hours when you only plan to trade the New York open produces misleading results. Match backtest conditions to intended execution environment.

Building Your Strategy Playbook

Document every aspect of your strategy before backtesting begins. Vague rules produce unrepeatable results.

Define Entry Criteria

Entry rules must be objective and specific. "Buy when price looks strong" isn't testable. "Buy when price closes above a 5 minute FVG" is testable.

Entry Components: Market condition filter (trending, ranging, volatile), technical setup trigger, confirmation signals, time of day restrictions if applicable

Example Entry Rules:

Only trade between 9:30 AM and 11:30 AM ET

Price must be below midnight for longs and above midnight for shorts

Wait for 5 minute order block to form

Enter long on the bullish order block or short on the bearish order block

The more specific your entry criteria, the more accurately you can test it.

Define Exit Criteria

Exits determine profitability more than entries. Test multiple exit approaches.

Profit Targets: Fixed pip/point/dollar amount, percentage gain, technical levels, trailing stops

Stop Losses: Fixed pip/point/dollar amount, percentage loss, technical stops, volatility-based (ATR multiples)

Time-Based Exits: End of session regardless of P&L, maximum bars in trade, overnight hold or flat

Example Exit Rules: Stop loss: 10 points below entry, profit target: 2RR, time stop: exit at market close if still open, trailing stop: move to breakeven once 1.5RR is reached

Document exactly when and why you exit trades. "Take profit when it feels right" isn't reproducible.

Determine Position Sizing

Position sizing impacts results dramatically. Fixed contract/share sizing creates different risk profiles than percentage-based sizing.

Make sure to check out our blogs for this, we shared a lot of important informations about position sizing.

Executing the Backtest

With preparation complete, run your historical simulation.

Apply Rules Consistently

Execute your strategy exactly as documented without deviation. The temptation to adjust based on hindsight is strong. Resist it.

Use the same discipline you'd apply in live trading. If your rule says enter at market close, don't give yourself the best price of the next bar. Use realistic execution prices including slippage estimates for market orders.

Track Every Trade, granular data enables deep analysis beyond just total profit/loss.

You should also support all of your backtesting with screenshots, as visual documentation helps refine discretionary elements and identify patterns.

Manual vs Software Backtesting

Two approaches exist for running backtests: manual or automated through software.

Manual Backtesting

Process: Open historical chart, scroll through bar by bar, manually mark entries/exits, record results in spreadsheet

Advantages: Deep familiarity with price action, develops pattern recognition, no coding required, complete control over discretionary decisions

Disadvantages: Extremely time consuming, prone to human error and bias, difficult to test large samples, hard to optimize parameters systematically

Best For: Discretionary strategies with subjective elements, initial strategy validation before coding, traders who learn kinesthetically through doing

Software Backtesting

Process: Define strategy rules in software, run automated simulation across historical data, receive statistical results

Advantages: Fast execution (years of data in minutes), eliminates human bias, large sample sizes easily tested, systematic parameter optimization possible

Disadvantages: Requires learning software or coding, discretionary elements difficult to program, potential for technical errors in code, over-optimization temptation

Best For: Systematic mechanical strategies, large scale testing across multiple symbols and timeframes, strategies with clear objective rules

Key Principles for Reliable Backtesting

Test What You'll Actually Trade: Match backtest conditions to intended execution environment exactly

Maintain Skepticism: Treat strong results with suspicion. Look for why they might be wrong.

Seek Robustness: Strategy should work across different timeframes, symbols, and periods. If it only works on one stock in 2021, it's not a strategy.

Accept Imperfection: No strategy wins 100% or has perfect metrics. Seek positive expectancy, not perfection.

Document Everything: Detailed documentation enables replication and refinement.

Combine with Forward Testing: Never go from backtest directly to full-size live trading.