Mike | The Lab

Published on

Jan 4, 2026

What Is Forex Trading?

Forex trading provides access to the world's largest financial market with $7.5 trillion in daily volume. With the right approach, forex offers 24-hour trading, high liquidity, and leverage opportunities that stocks can't match. Without understanding how currency pairs work, you're gambling, not trading.

Most traders jump into forex chasing quick profits without grasping pip movements, leverage risks, or which pairs match their strategy. The successful ones? They master currency mechanics before risking capital. They understand that forex is a skill, not a shortcut.

What Is the Forex Market?

The forex market, short for foreign exchange, is where currencies are traded against each other. It's the world's largest financial market, with over $7.5 trillion traded daily as of 2024, dwarfing stock and commodity markets combined.

Unlike centralized exchanges like the NYSE, forex operates as a decentralized over-the-counter market. Trades execute through computer networks connecting banks, brokers, institutions, and retail traders worldwide. There's no physical location where all forex transactions occur.

The forex market operates 24 hours per day, five days per week, closing only on weekends. Trading follows the sun across global financial centers: Sydney, Tokyo, London, and New York. This continuous operation creates opportunities around the clock but also means prices can move significantly while you're away from your screen.

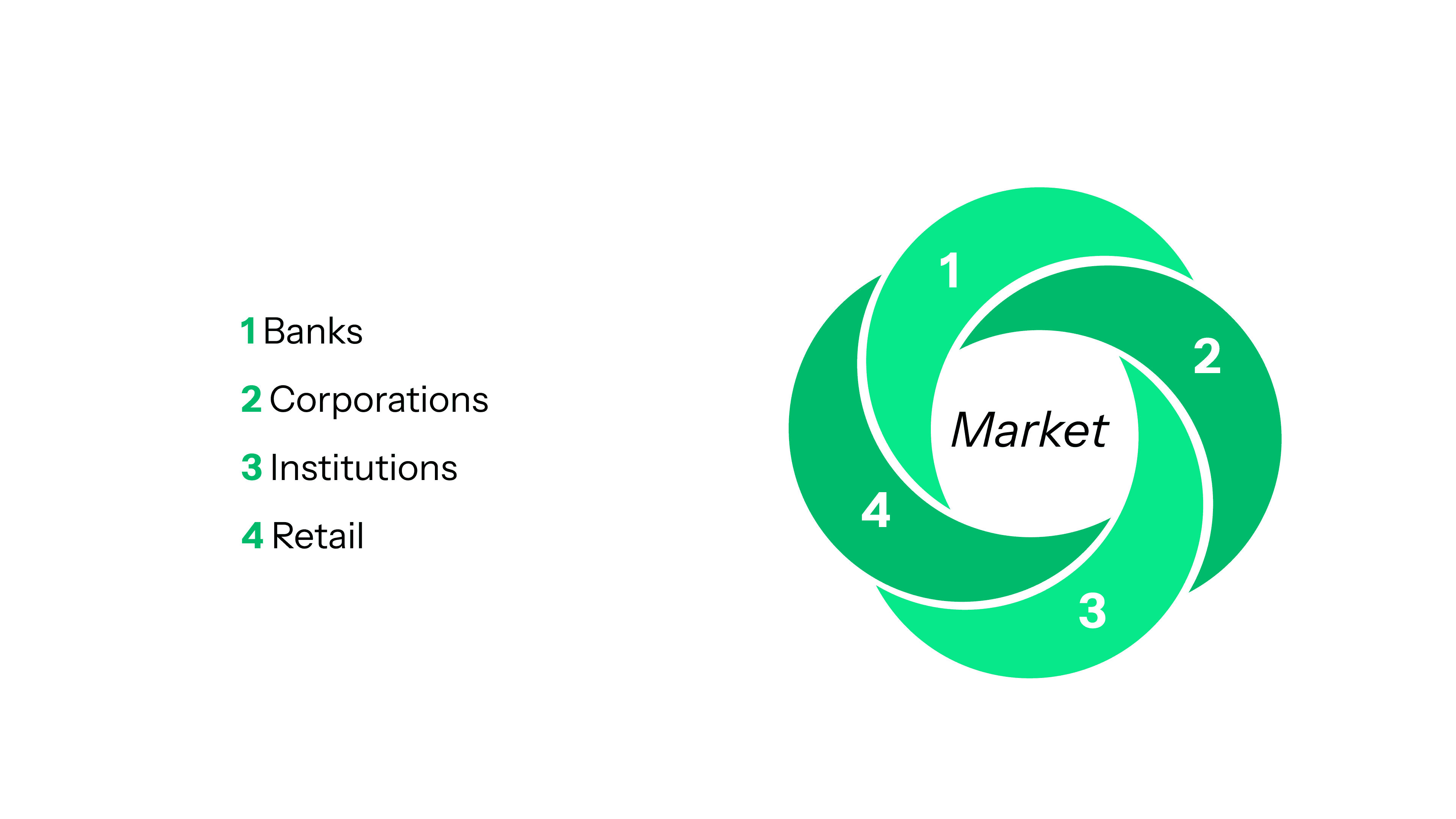

Market Participants

The forex market serves multiple purposes beyond speculation:

Central Banks: Manage currency reserves, implement monetary policy, intervene to stabilize exchange rates

Commercial Banks: Facilitate client transactions, provide liquidity, engage in proprietary trading

Corporations: Convert currencies for international business operations, hedge foreign exchange risk

Hedge Funds and Institutional Investors: Speculate on currency movements, arbitrage opportunities, portfolio diversification

Retail Traders: Individual speculators trading through online brokers, representing a small but growing market segment

Understanding that you're trading alongside major institutions helps contextualize the market's liquidity and why certain levels attract significant activity.

How Forex Trading Works

Currency Pairs Explained

Forex trading always involves two currencies forming a pair because you're simultaneously buying one currency and selling another. Every forex quote shows how much of the quote currency you need to buy one unit of the base currency.

Base Currency: The first currency in the pair, the one you're buying or selling

Quote Currency: The second currency in the pair, the one expressing the price

Example: EUR/USD = 1.1000 This means one euro costs $1.10. If you buy EUR/USD, you're buying euros and selling dollars. If you sell EUR/USD, you're selling euros and buying dollars.

Major Currency Pairs

The most traded pairs involve the US dollar and other major currencies:

EUR/USD (Euro/US Dollar): Most liquid pair, representing 24% of daily forex volume, typically lower spreads

USD/JPY (US Dollar/Japanese Yen): Second most traded, popular with algorithmic traders, influenced by Asian market dynamics

GBP/USD (British Pound/US Dollar): Known as "cable," more volatile than EUR/USD, influenced by UK economic data

USD/CHF (US Dollar/Swiss Franc): Swiss franc acts as safe-haven currency, inverse correlation with EUR/USD

USD/CAD (US Dollar/Canadian Dollar): Commodity currency, influenced by oil prices due to Canada's energy exports

AUD/USD (Australian Dollar/US Dollar): Commodity currency, influenced by China's economic health, gold and iron ore prices

NZD/USD (New Zealand Dollar/US Dollar): Similar to AUD, influenced by dairy prices and Asian demand

Cross Pairs and Exotics

Cross Pairs: Don't include the US dollar. Examples: EUR/GBP, EUR/JPY, GBP/JPY. These pairs offer diversification but typically have wider spreads.

Exotic Pairs: Include one major currency and one emerging market currency. Examples: USD/TRY (Turkish Lira), USD/ZAR (South African Rand). Higher spreads, lower liquidity, increased volatility.

Start with major pairs until you understand market mechanics. They offer the tightest spreads and most predictable behavior.

Understanding Pips and Price Movement

What Is a Pip?

A pip (percentage in point or price interest point) is the smallest whole unit price movement in forex. For most currency pairs, a pip is the fourth decimal place (0.0001). For Japanese yen pairs, a pip is the second decimal place (0.01).

Standard Pair Example: EUR/USD moves from 1.1000 to 1.1001, that's a 1 pip movement

Yen Pair Example: USD/JPY moves from 150.00 to 150.01, that's a 1 pip movement

Calculating Pip Value

Pip value determines your profit or loss per pip movement. For standard lots (100,000 units), most pairs have a pip value of $10. For mini lots (10,000 units), pip value is $1. For micro lots (1,000 units), pip value is $0.10.

Example Calculation: You buy 1 standard lot (100,000 units) of EUR/USD at 1.1000. The price rises to 1.1050. That's a 50 pip move. At $10 per pip, your profit is $500.

Understanding pip values is essential for position sizing and risk management. Your stop loss distance in pips multiplied by pip value determines your dollar risk per trade.

Factors Driving Forex Prices

Currency prices don't move randomly. Understanding what influences exchange rates helps you make informed trading decisions.

Economic Indicators

Interest Rates: Higher interest rates attract foreign investment, strengthening currency. Central bank policy decisions create significant volatility.

Inflation Data: Consumer Price Index (CPI) and Producer Price Index (PPI) influence central bank policy and currency values

Employment Reports: Non-Farm Payrolls (NFP) for USD, employment data for other currencies. Strong employment supports currency strength.

GDP Growth: Gross Domestic Product measures economic health. Strong growth typically supports currency appreciation.

Trade Balance: Deficits (importing more than exporting) can weaken currency. Surpluses can strengthen currency.

Political Events

Political stability and policy decisions dramatically impact currency values:

Elections: Unexpected results create volatility as markets reassess economic policies

Geopolitical Tensions: Wars, sanctions, diplomatic conflicts drive safe-haven flows to USD, CHF, JPY

Policy Changes: Brexit caused significant GBP volatility as markets digested implications

Central Bank Independence: Perceived political interference in central banks weakens currency confidence