Mike | The Lab

Published on

Jan 4, 2026

What Are Options?

Options trading opens access to sophisticated strategies that stocks alone can't provide. With the right approach, options offer leverage, hedging capabilities, and profit opportunities in any market direction. Without understanding the fundamentals, they become expensive mistakes.

Most traders jump into options without grasping how contracts work, how pricing functions, or which strategies match their goals. The successful ones? They master the mechanics before risking capital. They understand that options are tools, not lottery tickets.

What Is an Option Contract?

An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a certain date (the expiration date). This right comes at a cost called the premium.

Think of it as a reservation system. You pay upfront to lock in a price. If market conditions move in your favor, you can execute the contract and profit from the difference. If conditions move against you, your maximum loss is limited to the premium you paid, similar to losing a deposit.

Options are derivatives because their value derives from an underlying asset. That asset could be stocks, ETFs, indexes, commodities, currencies, or bonds. Each stock option contract typically represents 100 shares of the underlying security, providing leveraged exposure with defined risk.

Key Option Contract Components

Strike Price: The predetermined price at which you can buy or sell the underlying asset. This price remains fixed regardless of market movements.

Expiration Date: The last day you can exercise your right under the contract. Most equity options expire on the third Friday of each month. After expiration, the contract becomes worthless if not exercised.

Premium: The upfront cost to purchase the option contract. This is your maximum risk, paid regardless of whether you exercise the option. Premiums are quoted per share but represent 100 shares per contract.

Underlying Asset: The security the option derives its value from. When the underlying moves, the option's value changes in correlation.

Why Trade Options?

Options were originally created for hedging, allowing investors to protect portfolio positions against adverse price movements. Over time, traders discovered options also provide powerful speculative tools with defined risk parameters.

Portfolio Protection

Options function as insurance for your holdings. If you own stock and buy a put option, you establish a floor price below which your losses are limited. The premium you pay acts like an insurance policy premium, protecting against catastrophic drawdowns.

This protection proves valuable during volatile market periods. Rather than selling positions you believe in long-term, you can hedge through options and maintain exposure while limiting downside.

Leverage and Capital Efficiency

Options require significantly less capital than purchasing the underlying asset outright. A call option provides upside exposure to 100 shares for a fraction of the cost of buying those shares. This leverage amplifies both gains and losses, requiring strict risk management.

The capital efficiency allows traders to diversify across more positions or maintain cash reserves while maintaining market exposure.

Profit in Any Market Direction

Unlike stocks where profit requires price appreciation, options strategies generate returns in rising, falling, or sideways markets. Calls profit from upside movement, puts profit from downside movement, and certain strategies profit from low volatility or time decay.

This flexibility makes options valuable for traders who can identify market conditions but want more tactical approaches than simple long or short positions.

Defined Risk Parameters

With purchased options, your maximum loss is known upfront. The premium you pay is your total risk. This defined risk profile allows for precise position sizing and prevents catastrophic losses that unlimited-risk positions can create.

However, sold options carry different risk profiles, potentially unlimited in certain strategies. Understanding which side of the contract you're on determines your risk exposure.

Call Options vs Put Options

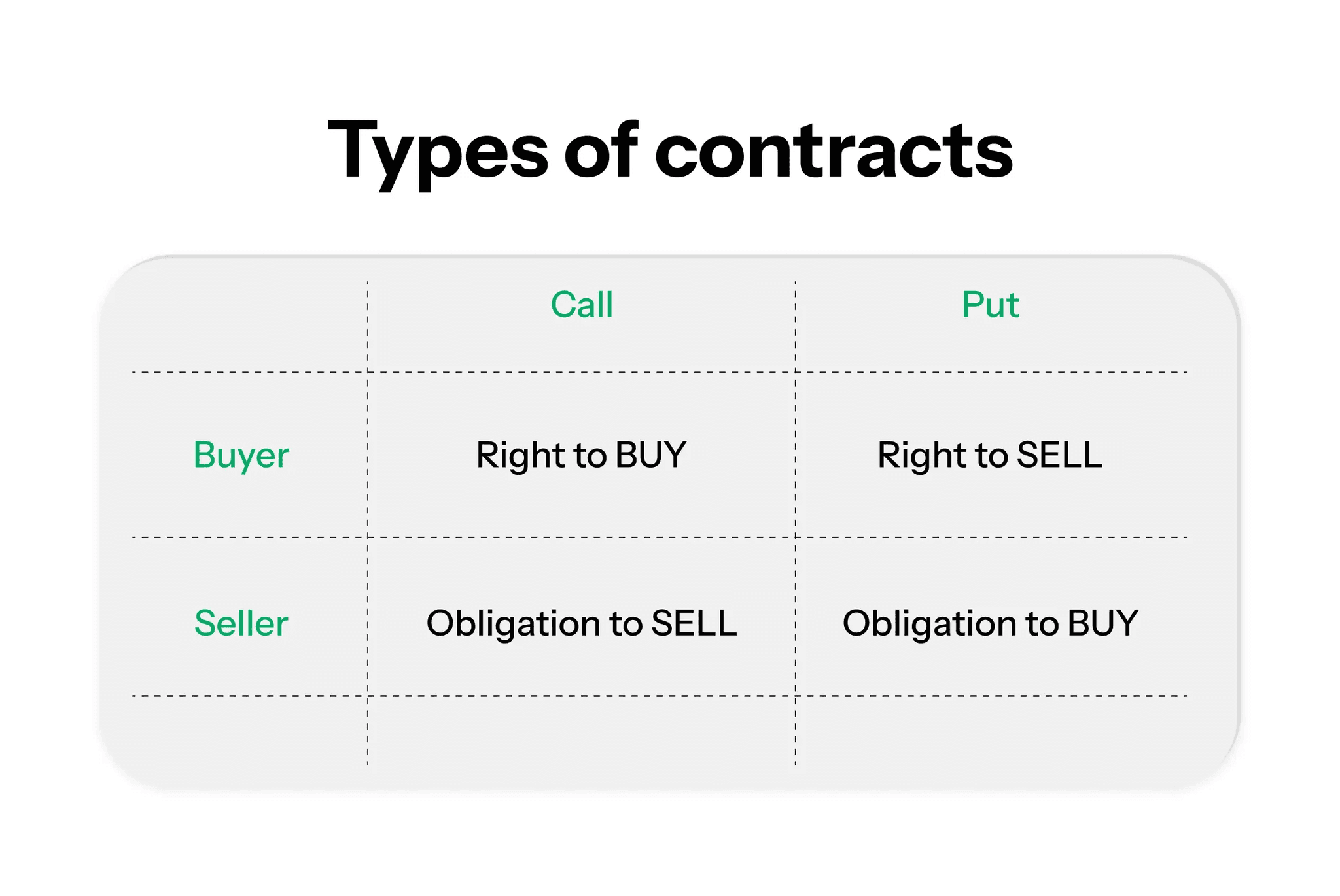

Every option is either a call or a put. Understanding these two categories is foundational to all options strategies.

Call Options Explained

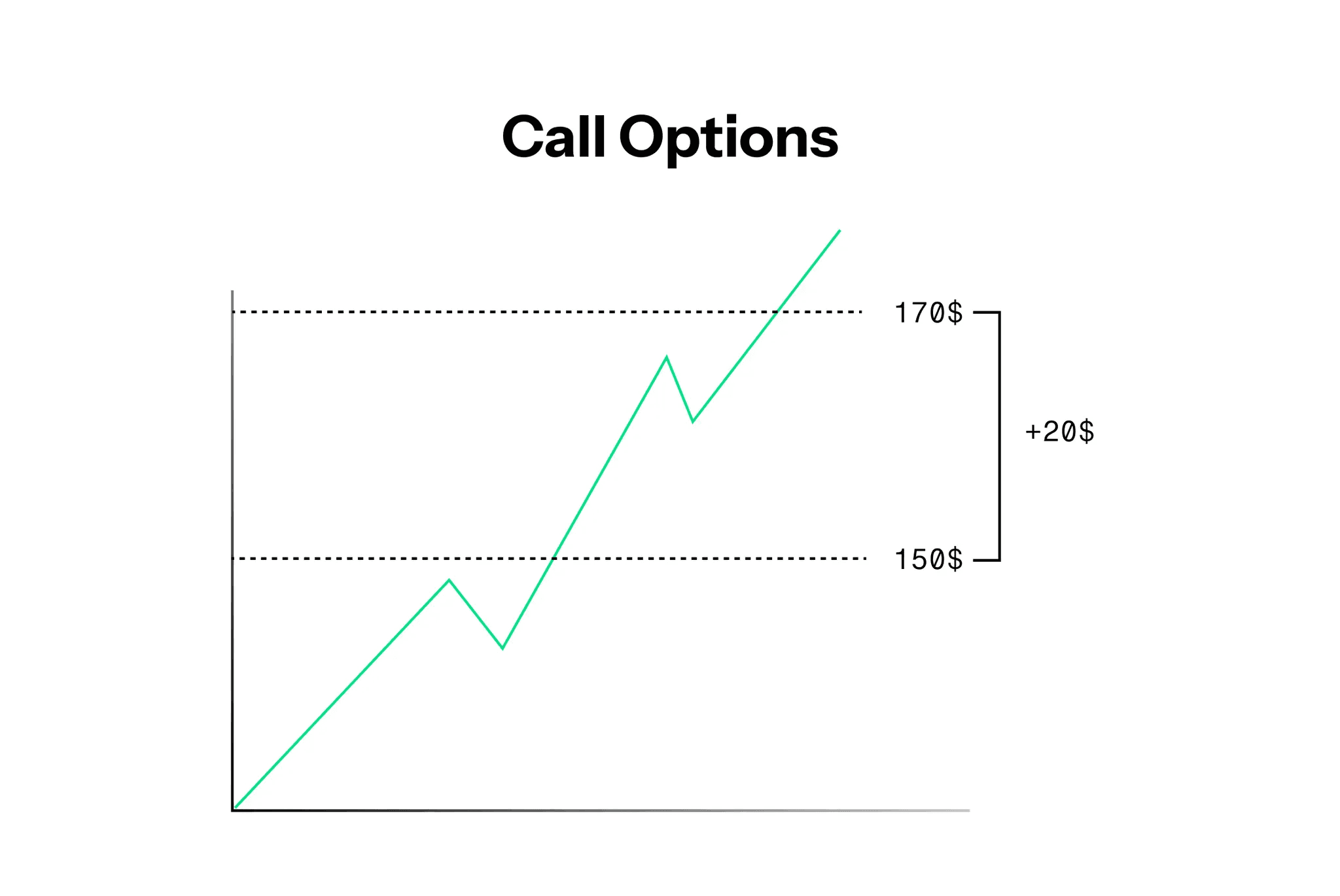

A call option gives you the right to buy the underlying asset at the strike price before expiration. Traders buy calls when they expect the underlying price to rise above the strike price plus the premium paid.

Call Option Example: Stock XYZ trades at $50. You buy a call option with a $55 strike expiring in 30 days for a $2 premium ($200 total for 100 shares).

If XYZ rises to $60 at expiration, your call is worth $5 ($60 market price minus $55 strike price), providing a $500 value minus the $200 premium paid equals $300 profit.

If XYZ stays below $55 at expiration, the call expires worthless and you lose the $200 premium paid.

Call options increase in value as the underlying asset price rises. They provide leveraged upside exposure with limited downside risk.

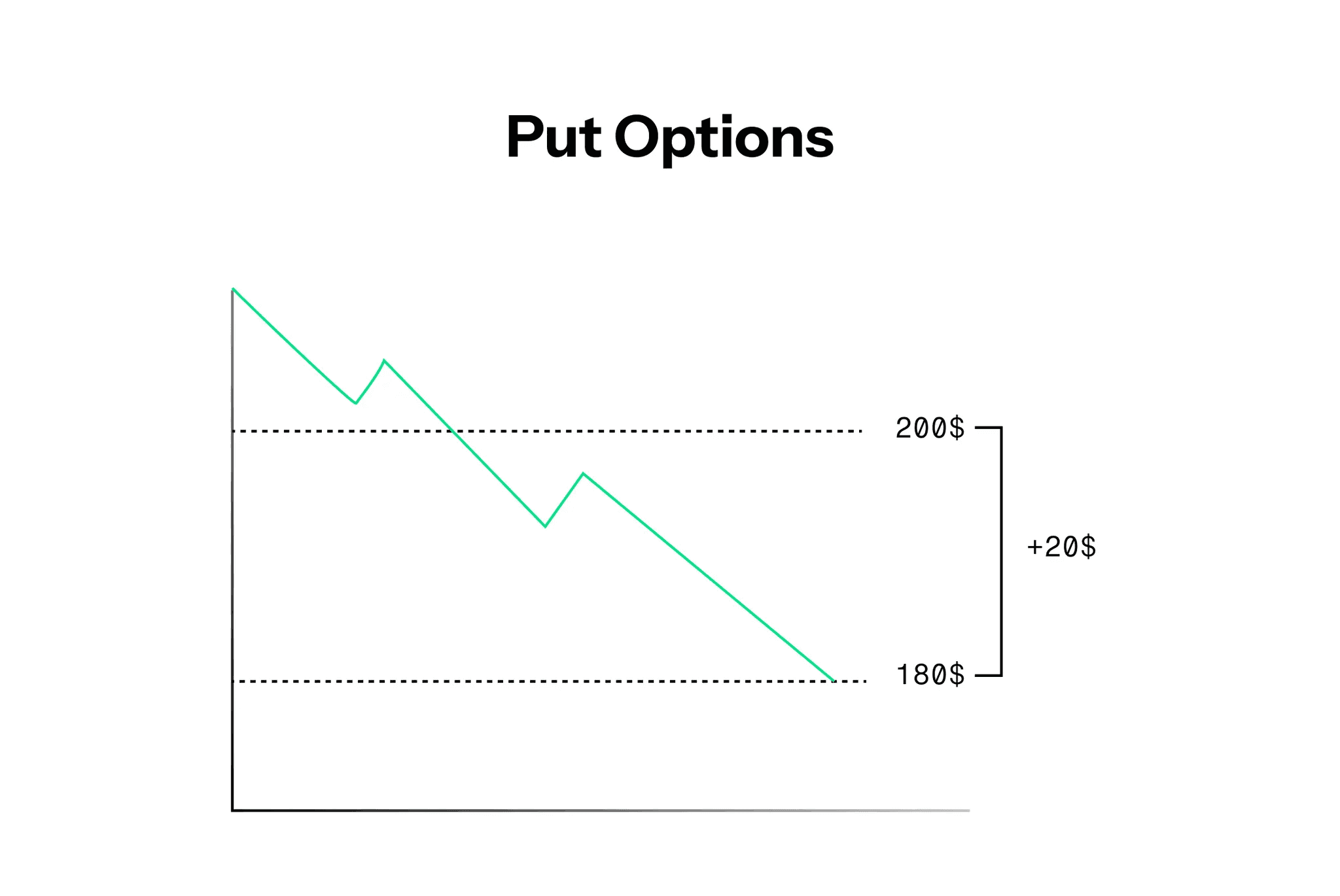

Put Options Explained

A put option gives you the right to sell the underlying asset at the strike price before expiration. Traders buy puts when they expect the underlying price to fall below the strike price minus the premium paid.

Put Option Example: Stock XYZ trades at $50. You buy a put option with a $45 strike expiring in 30 days for a $2 premium ($200 total).

If XYZ falls to $40 at expiration, your put is worth $5 ($45 strike price minus $40 market price), providing a $500 value minus the $200 premium paid equals $300 profit.

If XYZ stays above $45 at expiration, the put expires worthless and you lose the $200 premium paid.

Put options increase in value as the underlying asset price falls. They provide leveraged downside exposure or portfolio protection with limited risk.

Understanding Option Pricing Components

Options pricing isn't random. Several factors determine an option's premium at any given moment.

Intrinsic Value

Intrinsic value is the amount an option is in-the-money. For calls, it's the difference between the stock price and the strike price when the stock is above the strike. For puts, it's the difference between the strike price and the stock price when the stock is below the strike.

An option with no intrinsic value (out-of-the-money or at-the-money) is trading purely on extrinsic value.

Call Intrinsic Value Example: Stock at $55, $50 strike call has $5 intrinsic value

Put Intrinsic Value Example: Stock at $45, $50 strike put has $5 intrinsic value

Extrinsic Value (Time Value)

Extrinsic value represents the premium beyond intrinsic value. It's what you pay for the time remaining until expiration and the potential for the option to move further in-the-money.

Extrinsic value decays over time, accelerating as expiration approaches. This time decay benefits option sellers and hurts option buyers.

Volatility Impact

Volatility significantly affects option pricing. Higher implied volatility increases option premiums because there's greater potential for large price moves. Lower volatility decreases premiums.

When volatility is elevated, options are expensive. When volatility is suppressed, options are cheap. Understanding volatility cycles helps time entries and exits.

Time Decay (Theta)

Time decay, measured by theta, represents how much an option loses in value each day as expiration approaches. All else equal, options lose value every day.

Time decay accelerates in the final 30 days before expiration. Options with weeks remaining have minimal daily decay compared to options with days remaining.

Long option positions suffer from time decay. Short option positions benefit from time decay. This dynamic influences which strategies work in different market conditions.

Option Expiration and Exercise

Standard Expiration Cycles

Most equity options expire on the third Friday of each month. Some heavily traded securities also offer weekly options that expire every Friday.

At expiration, options are either exercised (if in-the-money) or expire worthless (if out-of-the-money). Most retail traders close positions before expiration rather than exercising.

In-the-Money at Expiration

Options that finish in-the-money by at least $0.01 are typically auto-exercised by your broker. For calls, you'll be assigned 100 shares at the strike price per contract. For puts, you'll be required to deliver 100 shares at the strike price per contract.

Ensure you have adequate capital to handle assignment or close positions before expiration to avoid unintended share positions.

Out-of-the-Money at Expiration

Options that finish out-of-the-money expire worthless. You lose the premium paid if you're long or keep the premium received if you're short.

There's no action required. The contracts simply cease to exist after market close on expiration Friday.