Mike | The Lab

Published on

Jan 26, 2026

What Is Trading Win Rate?

Win rate receives more attention than it deserves. Traders obsess over achieving 70%, 80%, or 90% win rates without understanding that profitability depends on the relationship between winners and losers, not just the percentage of winning trades.

Most traders chase high win rates while ignoring risk-reward ratios, leading to accounts that win often but lose overall. The successful ones? They understand that a 40% win rate with proper risk management outperforms an 80% win rate with poor money management.

Here's everything you need to know about trading win rate!

What Is Trading Win Rate?

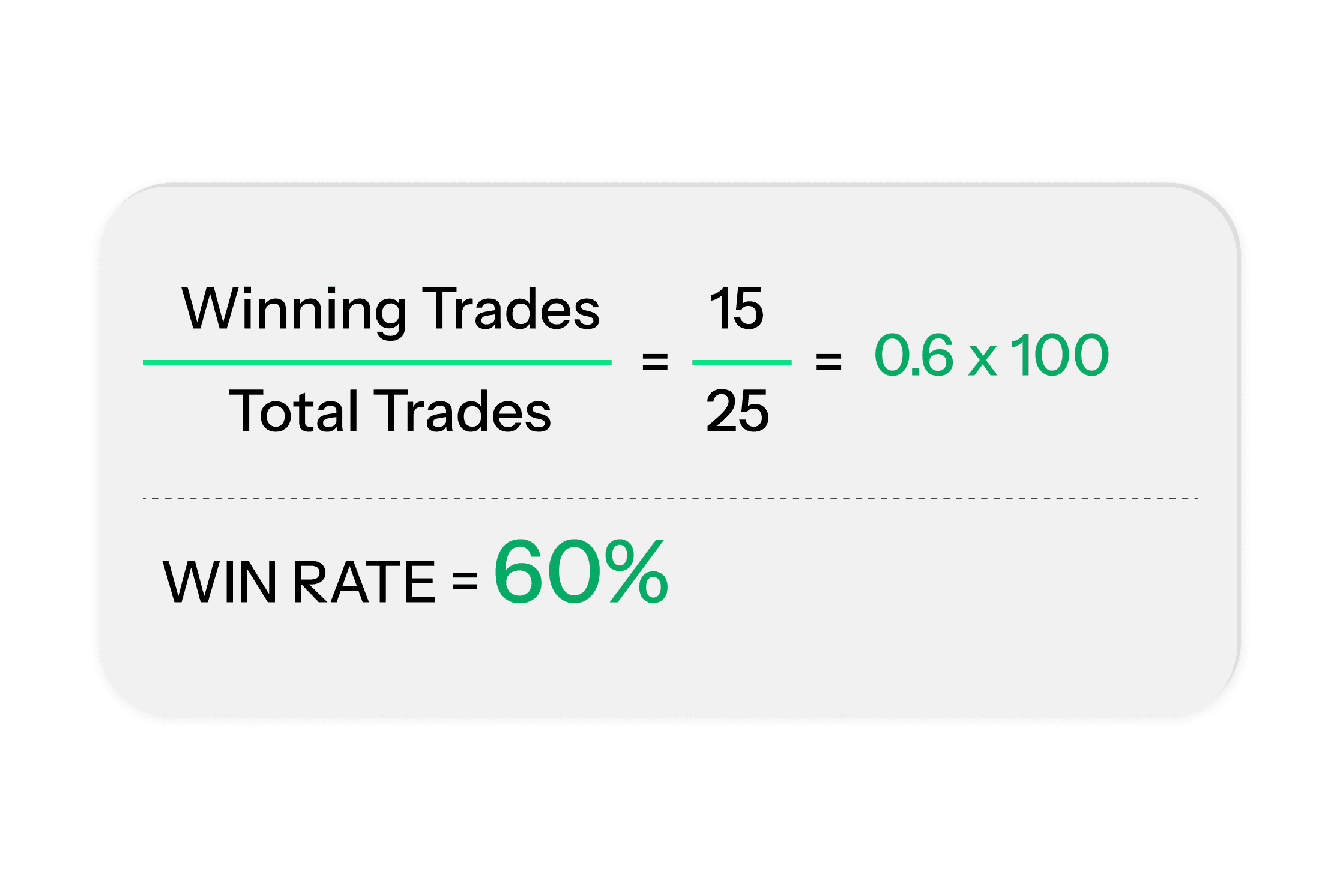

Trading win rate is the percentage of trades that close with a profit compared to total trades executed over a specific period. It's calculated by dividing winning trades by total trades and multiplying by 100.

Example: 15 winning trades out of 25 total trades = 60% win rate

Win rate is one performance metric among many. It tells you how often you're right but says nothing about how much you make when right or lose when wrong. This distinction is critical because it's entirely possible to have a high win rate while losing money overall.

Why Win Rate Gets Overemphasized

Win rate feels good psychologically. Being right 80% of the time satisfies ego and provides emotional validation. However, profitability doesn't care about your ego. It cares about total dollars made versus total dollars lost.

The trading industry often promotes high win rates because they sound impressive in marketing. "Trade with 85% accuracy!" makes a better headline than "Make 40% of your trades work with 1:3 risk-reward ratio." But the second statement could represent superior profitability.

How to Calculate Your Win Rate

Calculating win rate is straightforward, but the context matters more than the number itself.

Basic Calculation

Count your total trades over a defined period (week, month, quarter, year). Count how many closed with any profit. Divide winning trades by total trades. Multiply by 100 for percentage.

Example Calculation: Month of January trading results: 15 winning trades, 10 losing trades, 25 total trades

Win Rate = (15 ÷ 25) × 100 = 60%

The Win Rate Deception: Why High Win Rates Can Lose Money

This is where most traders' understanding breaks down. High win rates don't guarantee profitability.

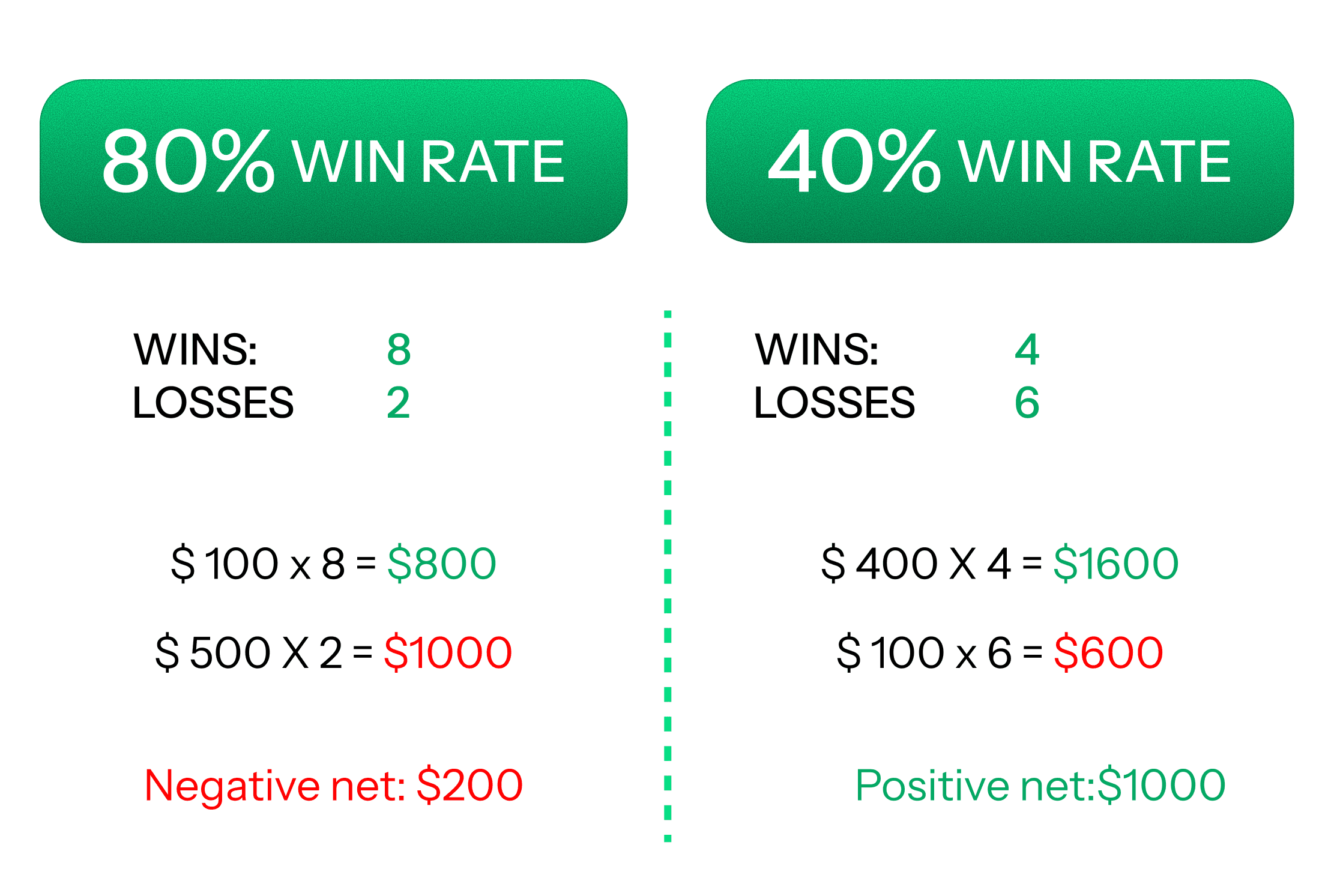

The Math Behind the Deception

Trader A: 80% Win Rate

10 trades total

8 winners averaging $100 profit each = $800

2 losers averaging $500 loss each = -$1,000

Net result: -$200 (losing overall despite 80% win rate)

Trader B: 40% Win Rate

10 trades total

4 winners averaging $400 profit each = $1,600

6 losers averaging $100 loss each = -$600

Net result: +$1,000 (profitable despite 40% win rate)

Trader B, with half the win rate of Trader A, is significantly more profitable. Why? Risk-reward ratio.

What Is an Acceptable Win Rate?

There is no universal "good" win rate. Acceptable win rate depends entirely on your risk-reward ratio and trading style.

Win Rate Requirements by Risk-Reward Ratio

To break even (not including commissions), you need different win rates at different risk-reward ratios:

1:1 Risk-Reward: Requires >50% win rate to profit

1:2 Risk-Reward: Requires >33% win rate to profit (risk $100 to make $200)

1:3 Risk-Reward: Requires >25% win rate to profit (risk $100 to make $300)

2:1 Risk-Reward: Requires >67% win rate to profit (risk $200 to make $100)

Common Win Rate Mistakes

Mistake 1: Chasing High Win Rates

Traders modify strategies to increase win rate without considering impact on expectancy.

Despite higher win rate, modified strategy may lower expectancy and profitability.

Solution: Optimize for expectancy, not win rate. Accept your strategy's natural win rate range.

Mistake 2: Cutting Winners to Maintain Win Rate

Taking profits early locks in wins but destroys average win size.

Solution: Follow your planned profit targets. Accept that some trades will reverse from profits to losses. This is normal and necessary for proper risk-reward ratios.

Mistake 3: Comparing Your Win Rate to Others

Every strategy has different characteristics. Your 45% win rate with 1:3 risk-reward might significantly outperform someone's 70% win rate with 1:1 risk-reward.

Solution: Compare your results to your own historical performance and strategy expectations, not to other traders.

Mistake 5: Not Tracking Win Rate by Setup Type

Aggregating all trades hides which specific setups work well and which don't.

Without separation, you might continue taking trades that destroy your overall performance.

Solution: Tag trades by setup type, time of day, market conditions. Calculate separate win rates for each.